Get the free 1040 nr ez 2008 us non resident alien form

Show details

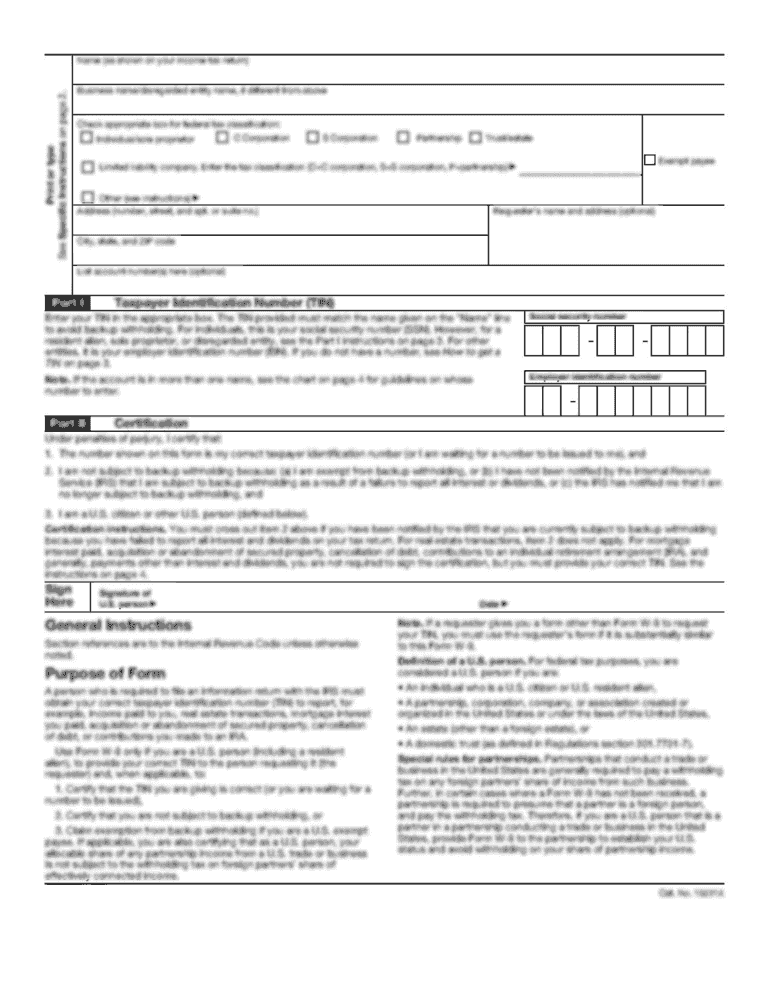

Also enter this amount on Form 1040NR line 37. Yes. Your deduction may be limited. See page 27 for the amount to enter here and on Form 1040NR line 37. See page 27 for expenses to deduct here. List type and amount Enter the amount from Form 1040NR line 36 Multiply line 13 by 2. 02 Other Other see page 27 for expenses to deduct here. List type and amount Total Itemized Is Form 1040NR line 36 over 159 950 over 79 975 if you checked filing status b...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your 1040 nr ez 2008 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 1040 nr ez 2008 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 1040 nr ez 2008 online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit 1040 nr ez 2008. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents.

How to fill out 1040 nr ez 2008

How to fill out 1040 nr ez 2008?

01

Gather all necessary documents such as your W-2 forms, 1099 forms, and any other tax-related documents.

02

Fill out your personal information including your name, address, and social security number on the top section of the form.

03

Indicate your filing status by checking the appropriate box (single, married filing jointly, etc.).

04

Calculate your total income by adding up all the income you received during the tax year, and enter it in the designated box.

05

Deduct any applicable exemptions and write the final adjusted income in the respective box.

06

Determine your total tax liability by referring to the tax rate schedule provided and enter the amount in the appropriate box.

07

If you have already paid a portion of your taxes through withholding or estimated tax payments, subtract that amount from your total tax liability.

08

Calculate your refund or the amount you still owe by comparing your total tax liability with the amount you have already paid.

09

Provide your bank account information if you would like to receive your refund through direct deposit.

10

Sign and date the form, and attach any required schedules or additional documents.

Who needs 1040 nr ez 2008?

01

Nonresident aliens who earned income in the United States during the tax year 2008.

02

Individuals who do not qualify for the simpler version of the form, 1040NR.

03

Nonresident aliens who need to file their taxes and claim any applicable deductions or credits for that tax year.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 1040 nr ez us?

1040 NR EZ is the shortened version of the U.S. Individual Income Tax Return for Certain Nonresident Aliens with No Dependents.

Who is required to file 1040 nr ez us?

Nonresident aliens who have earned income from the United States and meet certain criteria are required to file Form 1040 NR EZ.

How to fill out 1040 nr ez us?

To fill out Form 1040 NR EZ, you need to provide your personal information, income details, deductions, exemptions if applicable, and calculate your tax liability using the provided instructions.

What is the purpose of 1040 nr ez us?

The purpose of Form 1040 NR EZ is to report and calculate the tax liability of nonresident aliens who have earned income in the United States.

What information must be reported on 1040 nr ez us?

Form 1040 NR EZ requires the reporting of personal information, such as name, address, and taxpayer identification number, as well as income details, deductions, exemptions, and tax payments.

When is the deadline to file 1040 nr ez us in 2023?

The deadline to file Form 1040 NR EZ for the tax year 2023 is April 17, 2024.

What is the penalty for the late filing of 1040 nr ez us?

The penalty for late filing Form 1040 NR EZ is generally 5% of the unpaid tax liability for each month or part of a month that the return is late, up to a maximum of 25% of the unpaid taxes.

How can I manage my 1040 nr ez 2008 directly from Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your 1040 nr ez 2008 and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How can I edit 1040 nr ez 2008 from Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your 1040 nr ez 2008 into a dynamic fillable form that you can manage and eSign from anywhere.

Can I create an electronic signature for the 1040 nr ez 2008 in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your 1040 nr ez 2008 in minutes.

Fill out your 1040 nr ez 2008 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.